At its core, a liquefied natural gas supplier is a company that produces, ships, and delivers LNG across the globe. They are the essential link in the world’s energy supply chain, managing the incredibly complex process of cooling natural gas down to a staggering -260°F (-162°C).

This chilling process transforms the gas into a dense, transportable liquid. Why does that matter? It's what makes it possible to load massive amounts of energy onto specialized ships and send it across oceans to power homes and industries far from the source.

Understanding the Global LNG Supply Landscape

The world of liquefied natural gas runs on a massive, intricate logistics network, with LNG suppliers as the master coordinators. Don't think of them as just fuel sellers; they are more like managers of a global energy highway. Their work starts at the gas fields, runs through enormous liquefaction plants, and continues onto specialized, ocean-crossing tankers.

This journey is what unlocks natural gas reserves in places like the United States or Qatar, making that energy available to markets thousands of miles away that need it. Without this sophisticated supply chain, the way we distribute energy around the world would be completely different.

The Dynamics of Supply and Demand

The LNG market is in a constant state of flux, pushed and pulled by everything from economic growth and geopolitical events to something as simple as the weather. A major trend to watch is the interplay between the big exporting and importing regions. Recent data, for example, shows just how quickly global trade flows can shift in response to regional needs.

The global LNG trade grew by 2.4% in 2024, hitting 411.24 million tonnes and connecting 22 exporting markets with 48 importing ones. This growth highlights the expanding reach of LNG suppliers and their critical role in keeping the world's energy supply stable.

This data tells a fascinating story. While the Asia Pacific region cemented its spot as the top LNG exporter, European imports actually dropped sharply, thanks to high storage levels and a steady supply of pipeline gas. At the same time, demand in Asia—especially from China and India—shot up due to heatwaves and growing industrial needs.

It's a perfect example of how liquefied natural gas suppliers must constantly pivot and adapt to a fluid global marketplace. You can dive deeper into these trends by checking out the 2025 World LNG Report.

Getting a handle on these market dynamics is the first step. It shows you just how vital these suppliers are in making sure energy gets where it needs to go, balancing the scales of supply and demand across entire continents. This groundwork is key to understanding why choosing the right LNG partner is such a critical decision for any business or country relying on natural gas.

Identifying the Key Players in LNG Supply

The global LNG market isn't a chaotic free-for-all. It's an arena dominated by a handful of powerful nations and corporations that act as the main hubs and shipping lines for a worldwide energy transit system. A few key countries, thanks to massive natural gas reserves and the deep pockets needed for liquefaction plants, really set the tempo for the entire industry.

These are the nations that have truly mastered the complex technology and logistics behind LNG exports. Their strategic locations and enormous production capacity give them a serious advantage, letting them ship energy to regions thousands of miles away.

The National Powerhouses of LNG

When you look at liquefied natural gas suppliers, a trio of countries consistently stands at the top of the global leaderboard. The United States, Australia, and Qatar form the top tier of LNG exporters, and between them, they are responsible for a massive chunk of the world's supply. Their dominance comes down to a combination of geological good fortune and staggering investment in the right infrastructure.

The United States, for example, has climbed the ranks incredibly fast to become a leading exporter. Together, the U.S., Australia, and Qatar ship roughly 60% of the global LNG supply. This concentration really underscores how critical they are to global energy security and price stability. With the U.S. slated to expand its capacity even more, its role as a key player is only getting stronger. You can learn more about the shifting dynamics of global LNG supply chains to see how these forces are evolving.

The Corporate Giants Orchestrating the Flow

Behind the national export numbers are the multinational corporations actually managing the journey from the gas field to the final customer. These are the companies that own the liquefaction trains, run the tanker fleets, and hammer out the complex contracts that keep the energy moving.

These corporate players generally fall into a few distinct categories:

- International Oil Companies (IOCs): Think of giants like Shell, TotalEnergies, and ExxonMobil. They operate across the entire value chain, possessing the capital and know-how to handle mega-projects from initial exploration all the way to the final sale.

- National Oil Companies (NOCs): These are state-owned behemoths like QatarEnergy or China's CNPC, which control their home country's resources. They are the primary drivers of national energy strategy and frequently team up with IOCs on major projects.

- Independent Producers: Companies like Cheniere Energy in the U.S. have carved out a niche focusing specifically on liquefaction and export. They were trailblazers for the U.S. export model, buying gas from domestic producers and selling the finished LNG to buyers around the world.

These companies aren't just selling a product; they're conducting an intricate ballet of production, logistics, and finance. They have to juggle risks that range from volatile market prices to simmering geopolitical tensions, all while ensuring a reliable stream of energy reaches the countries that depend on it.

How to Evaluate and Select an LNG Supplier

Choosing between liquefied natural gas suppliers isn't like picking a vendor from a catalog. It's much more like forging a long-term strategic partnership. You’re not just buying a commodity; you’re investing in the reliability, flexibility, and energy security that will power your entire operation.

Finding the right partner requires a deep dive into their capabilities. This means looking past the price sheet to scrutinize their infrastructure, the resilience of their supply chain, and the stability of their operational footprint. A supplier with a robust and diversified portfolio is simply better prepared to navigate the inevitable market shifts and disruptions.

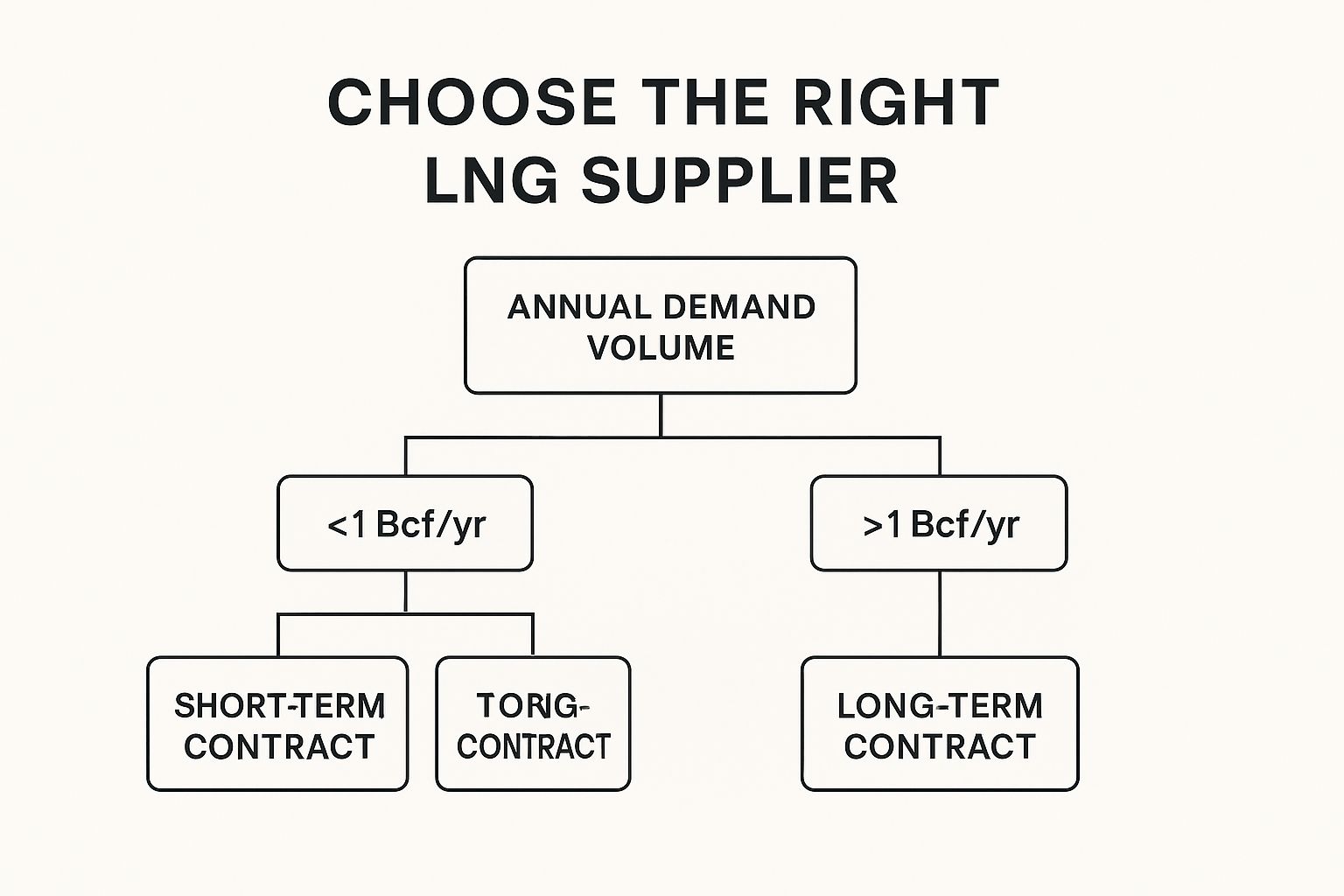

This decision tree gives a high-level view of how your needs, specifically your consumption volume, can point you toward the right kind of contract from the start.

As the graphic shows, your annual demand is often the first fork in the road, heavily influencing whether a short-term or long-term agreement makes the most sense.

Assess Supply Reliability and Diversity

The absolute bedrock of any supplier relationship is reliability. Can they consistently get you the LNG you need, when you need it? It’s a simple question with huge implications—a single late delivery can shut down operations and trigger serious financial consequences.

Dig into their history. What’s their track record for on-time deliveries, especially during tight market conditions or periods of high demand? A huge indicator of reliability is the diversity of their supply sources. A supplier who isn't tethered to a single gas field or liquefaction plant is far less vulnerable to localized disruptions, whether they're operational or geopolitical.

A supplier with access to multiple liquefaction facilities in different parts of the world dramatically lowers your supply chain risk. Think of it as an insurance policy against the unexpected.

This geographic diversification means that if one source goes offline, they have the flexibility to reroute supply from another, ensuring you get a continuous flow of energy.

Examine Infrastructure and Technical Capability

A supplier’s physical assets—their liquefaction plants, storage tanks, and tanker fleet—are a direct reflection of their service quality. State-of-the-art infrastructure isn’t just about looking good; it signals a deep commitment to safety, efficiency, and environmental responsibility.

Ask potential liquefied natural gas suppliers about the age and maintenance records of their equipment. Modern, well-maintained facilities are less likely to have unplanned outages and often operate more efficiently, which can lead to more predictable pricing for you.

You should also get a feel for their logistical network and technical support. A strong partner like Blue Gas Express, for example, shows its depth not just in massive-scale supply but also by offering nimble, mobile solutions for temporary or emergency situations. That kind of technical versatility proves they're ready to tackle a wide range of challenges.

Evaluate Contract Flexibility and Geopolitical Stability

The contract is where the rubber meets the road. While long-term agreements are great for locking in price stability, the energy market is anything but static. You need a supplier who builds a degree of flexibility into their contracts. This could mean options for adjusting volumes or even destination flexibility, which gives you the power to redirect a cargo if your needs change.

Finally, don’t overlook the geopolitical climate of the supplier’s home base. The political and regulatory environment in their country can directly impact their ability to honor a long-term agreement. Suppliers operating out of stable, predictable nations are almost always the lower-risk choice for securing an uninterrupted energy supply for years to come.

To help you organize your evaluation process, here’s a checklist you can use when talking to potential suppliers.

LNG Supplier Evaluation Checklist

| Evaluation Criterion | Key Questions to Ask | Why It Matters |

|---|---|---|

| Supply Chain Resilience | Where do you source your natural gas? How many liquefaction plants do you operate or have access to? What is your contingency plan for a major supply disruption? | Diverse sources protect you from regional operational issues, political instability, or natural disasters, ensuring a continuous supply. |

| Logistical & Technical Infrastructure | What is the age and condition of your LNG tanker fleet? Do you own or charter your vessels? What technical support and engineering services do you offer? | Modern, well-maintained assets mean fewer delays and a lower risk of service failure. In-house technical expertise is a sign of a true partner. |

| Track Record & Reliability | Can you provide data on your on-time delivery performance? What is your safety record (e.g., incident rates)? Can you share references from long-term customers? | Past performance is the best predictor of future reliability. A strong safety culture minimizes risk to both personnel and operations. |

| Contractual Flexibility | What options are available for volume adjustments (up or down)? Do your contracts allow for destination flexibility? What are the terms for force majeure events? | The energy market changes. Flexible contract terms allow you to adapt to new circumstances without facing severe penalties. |

| Financial & Geopolitical Stability | Is the company financially stable? What is the political and regulatory environment of your primary country of operation? | A financially sound supplier in a stable country is more likely to be a reliable partner for the duration of a multi-year contract. |

Using a structured checklist like this ensures you cover all your bases and can make a truly informed, side-by-side comparison of potential partners.

Navigating LNG Contracts and Pricing

Getting a steady supply of liquefied natural gas is about more than just finding someone who produces it. You have to get into the weeds of the commercial agreements that define the entire relationship. While LNG contracts can seem complicated at first glance, they really come down to a choice between security and flexibility.

Think of it like buying a house. You can get a fixed-rate mortgage, which is a lot like a long-term contract in the LNG world. You're committing to one supplier for 10 to 25 years, locking in your supply and getting much more stable, predictable pricing. This is the bedrock of huge energy projects that need that kind of security to get multi-billion-dollar financing off the ground.

The alternative is the spot market, which is more like an adjustable-rate mortgage. Here, you're buying individual LNG cargoes as you need them. This gives you incredible freedom to react to sudden demand or jump on a good price. Of course, the trade-off is that you're riding the waves of market volatility.

Decoding LNG Pricing Models

The price tag on LNG is rarely a simple number. It's almost always a calculation based on one of two main models, and knowing how they work is critical when you sit down at the negotiating table with liquefied natural gas suppliers.

Oil-Indexed Pricing: This is the old-school way of doing things. The price of LNG is tied directly to a major crude oil benchmark, like Brent. For years, this was the standard because it gave both buyers and sellers a familiar, stable point of reference in the broader energy market.

Hub-Based Pricing: This newer approach connects the LNG price to the real-time supply and demand at major natural gas trading hubs, like the Henry Hub in the U.S. or the TTF in Europe. The price you pay actually reflects what gas is worth at that moment, not oil.

The big difference? Oil-indexed contracts give you predictability based on a massive, established global market. Hub-based pricing, on the other hand, gives you a price that’s a true reflection of natural gas market fundamentals, which can mean big savings when the gas market is oversupplied.

To make this clearer, let's break down how these two pricing structures stack up against each other.

Comparison of LNG Pricing Models

The table below compares the two primary models used for pricing liquefied natural gas in supply contracts.

| Pricing Model | How It Works | Primary Benefit | Primary Drawback |

|---|---|---|---|

| Oil-Indexed | The LNG price is calculated as a percentage of a major crude oil benchmark (e.g., Brent). | Provides long-term price stability and predictability, mirroring the broader energy market. | Can become disconnected from actual natural gas supply and demand, leading to inflated costs. |

| Hub-Based | The price is linked to a natural gas trading hub (e.g., Henry Hub, TTF) plus costs for liquefaction and shipping. | Offers transparent pricing that accurately reflects current gas market conditions and fundamentals. | Can be highly volatile, with prices swinging dramatically based on short-term market events. |

So, which path is right for you? It really boils down to your company's appetite for risk and its long-term strategy.

If your absolute top priority is security, a long-term, oil-indexed contract is a safe bet. But if you value agility and see an opportunity to save money by playing the market, a flexible, hub-priced spot buying strategy might be the smarter move.

The Future of Global LNG Supply Chains

The global energy map is being redrawn, and the liquefied natural gas supply chain is right at the heart of it all. As we look to the horizon, the industry isn't just growing—it's preparing for a massive expansion, backed by huge investments in new infrastructure. This isn't just a small step up; it's a foundational change that will redefine how energy moves around the world for decades.

Think of the current LNG market as a busy highway. What’s coming is like adding several new superhighways, all built to move more energy, faster, and to more destinations than ever before. This expansion is set to change everything, from global energy prices to how quickly the world can transition to new energy sources.

The Coming Capacity Boom

A huge wave of new supply is about to hit the market, and it's going to completely change the game for liquefied natural gas suppliers. This growth is mostly coming from two key regions that are seriously ramping up their export muscle: North America and Qatar. Their investments are paving the way for a more connected and fluid global market.

By 2030, the global LNG supply capacity is expected to jump by an incredible 350 billion cubic meters (Bcm). That's a massive 54% increase from 2024 levels. This is mostly driven by major projects in the U.S. and Canada, plus Qatar's huge North Field expansion, which is set to boost its own output by 85%. This kind of growth shows that LNG is expected to play an even bigger part in global energy security. You can find more insights on the future of LNG supply from PwC.

This surge in production is a direct answer to the soaring demand we’re seeing, especially from fast-growing economies in Asia. Suppliers are getting into position to meet that need, making sure they can provide reliable energy to fuel industrial growth and raise living standards for millions of people.

Meeting New Demand and Navigating Challenges

With production on the rise, the focus for suppliers is now shifting to distribution and smart new approaches. New trade routes are opening up, and the industry is learning to navigate a more complicated geopolitical landscape. This means we don't just need more ships; we need smarter logistics and more flexible supply contracts.

At the same time, the industry is up against a major challenge that also happens to be its biggest opportunity: decarbonization. The global push for a lower-carbon future is sparking innovation all along the supply chain.

The next frontier for leading LNG suppliers isn't just about delivering more gas; it's about delivering cleaner gas. Innovations like carbon-neutral LNG, where emissions are offset throughout the value chain, are moving from concept to reality.

This double focus on expansion and sustainability is what will define the industry's next chapter. Suppliers are now expected to provide energy security while also helping meet climate goals. To do this, they're investing in key technologies and strategies:

- Methane Emissions Reduction: Using advanced monitoring and leak detection to cut down on this potent greenhouse gas during production and transport.

- Carbon Capture and Storage (CCS): Building CCS technology into liquefaction plants to grab CO2 before it ever reaches the atmosphere.

- Energy Efficiency: Fine-tuning the liquefaction process, which uses a lot of energy itself, to shrink its own carbon footprint.

The future for liquefied natural gas suppliers is a mix of dynamic growth and responsible innovation. The companies that can strike the right balance between expanding their supply and making a real commitment to decarbonization will be the ones who lead the market, shaping a more resilient and sustainable global energy system for years to come.

Still Have Questions About LNG Suppliers? Let's Clear Things Up.

When you're looking into liquefied natural gas, a few key questions always pop up, especially if you're trying to figure out who to partner with. Getting a handle on the different types of suppliers out there is the first step to making a smart decision.

Integrated Suppliers vs. Trading Houses: What's the Real Difference?

So, who are the main players in the LNG game? You'll typically run into two major categories: integrated suppliers and trading houses.

Think of an integrated supplier as the all-in-one shop. These are usually the huge energy companies that own and operate everything from the gas wells right down to the delivery tankers. Because they control the entire journey, you get a ton of reliability and a very steady, predictable supply.

A trading house, on the other hand, is more like a savvy broker in the global energy marketplace. They don't produce the LNG themselves; instead, they specialize in buying and selling it, capitalizing on market shifts. They offer incredible flexibility and can source gas from all over the world, which is great if you don't want to be locked into a single long-term contract.

Geopolitical instability in major producing regions can disrupt supply chains and cause price spikes. For instance, conflict can interrupt production or block shipping routes, increasing demand from more stable regions. Buyers often prefer liquefied natural gas suppliers in countries with stable political environments to minimize these risks.

It's also worth remembering that it's not just about the global giants. There are many smaller, regional suppliers who have carved out a niche for themselves. These companies are often experts in specific areas, like providing LNG for marine fuel (bunkering) or setting up custom power solutions for remote industrial sites.

For reliable, on-demand mobile LNG solutions to keep your project on schedule, contact Blue Gas Express. Learn how we provide temporary natural gas services.