Think of a gas analysis service as giving your natural gas a thorough molecular health check. It’s far more than a simple test; it's a deep diagnostic dive that maps out the exact chemical composition, quality, and energy potential locked inside a gas sample. This data is the bedrock for ensuring safety and pinning down the precise economic value of your product.

Understanding the Molecular Fingerprint of Natural Gas

Imagine a natural gas stream is like a complex soup. Methane is the main ingredient, sure, but there are dozens of other compounds floating around in there. A gas analysis service acts like a master chef, carefully identifying every single one of those ingredients to give you the complete recipe. This "molecular fingerprint" is absolutely critical for just about every decision you'll make.

Without it, you're flying blind. You wouldn't know the exact energy content of what you're selling, whether dangerous contaminants are lurking in the stream, or if your gas even meets the strict quality standards required for transport. This service provides the fundamental data that drives everything from operational safety all the way to financial accounting.

Why This Analysis Matters

The report you get from a gas analysis isn't just a list of percentages; it's a source of actionable intelligence. Here’s what you really learn from a professional analysis:

- Pinpointing Economic Value: The analysis calculates the British Thermal Unit (BTU), or heating value, which is the single most important factor in setting the price. Higher BTU means more energy, and that translates directly to higher value.

- Protecting Your Assets: It flags corrosive compounds like hydrogen sulfide (H2S) and water vapor. These contaminants can chew through expensive pipelines and equipment, so catching them early prevents catastrophic failures and serious safety risks.

- Staying Compliant: Before gas can enter a pipeline, it has to meet very specific compositional standards, often called "pipeline specs." The analysis is your proof that the gas is clean and compliant, avoiding fines or rejection at the custody transfer point.

This whole process is more than just getting lab results back. A proper gas analysis service ties together expert sample collection, sophisticated lab techniques, and clear-headed interpretation. It’s about turning raw numbers into a clear, reliable picture of your gas quality and its true worth.

The Role of Gas Analysis in the Energy Industry

Think of accurate gas analysis as the invisible engine driving the entire energy industry. From the moment natural gas comes out of the ground until it's used in our homes, precise data about its composition is what informs every major decision. Without it, the industry would be flying blind, facing massive financial and safety risks.

A professional gas analysis service provides this essential intelligence. Its impact is felt everywhere, from upstream extraction and midstream transport all the way to downstream processing, tying operational decisions directly to commercial success.

From Upstream Wells to Downstream Refineries

The story starts at the source. For upstream producers, gas analysis is fundamental to understanding a reservoir's potential. Is the well rich in valuable hydrocarbons? The data tells them exactly what they're dealing with, shaping production strategies and helping to forecast a well's economic viability.

Once extracted, the gas enters the vast network of midstream pipelines. This is where analysis becomes absolutely critical for custody transfer—the official hand-off point where ownership changes. Accurate energy content (BTU) measurement ensures everyone is billed fairly. At the same time, monitoring for corrosive troublemakers like H₂S and water protects the integrity of multi-million dollar pipeline infrastructure.

Finally, the gas arrives at downstream facilities, like processing plants and refineries. Here, that same compositional data is used for fine-tuning operations. Knowing the exact mix allows them to efficiently strip out valuable natural gas liquids (NGLs) such as propane and butane, maximizing the value of every cubic foot.

This diagram shows the typical journey of natural gas through a processing plant, with analysis playing a critical role at every single step.

As you can see, the entire process of removing impurities and separating components is guided by the data gathered from gas analysis.

The Growing Importance of Data in Energy

The appetite for this kind of precise data is exploding. The oil and gas analytics market, which goes hand-in-hand with gas analysis, was valued at around USD 8.9 billion in 2024. Projections show it rocketing to USD 103.6 billion by 2035. This isn't just a trend; it's a fundamental shift toward using hard data to optimize every corner of the business. You can discover more about the trends in the oil and gas analytics market and see how they are reshaping the industry.

A gas analysis report is so much more than a sheet of technical numbers. It’s a vital business tool. It's the foundation for billion-dollar transactions, the bedrock of operational safety, and the key to regulatory compliance. This data empowers everyone in the value chain to make smarter, safer, and more profitable decisions.

A Look Inside the Gas Analysis Process

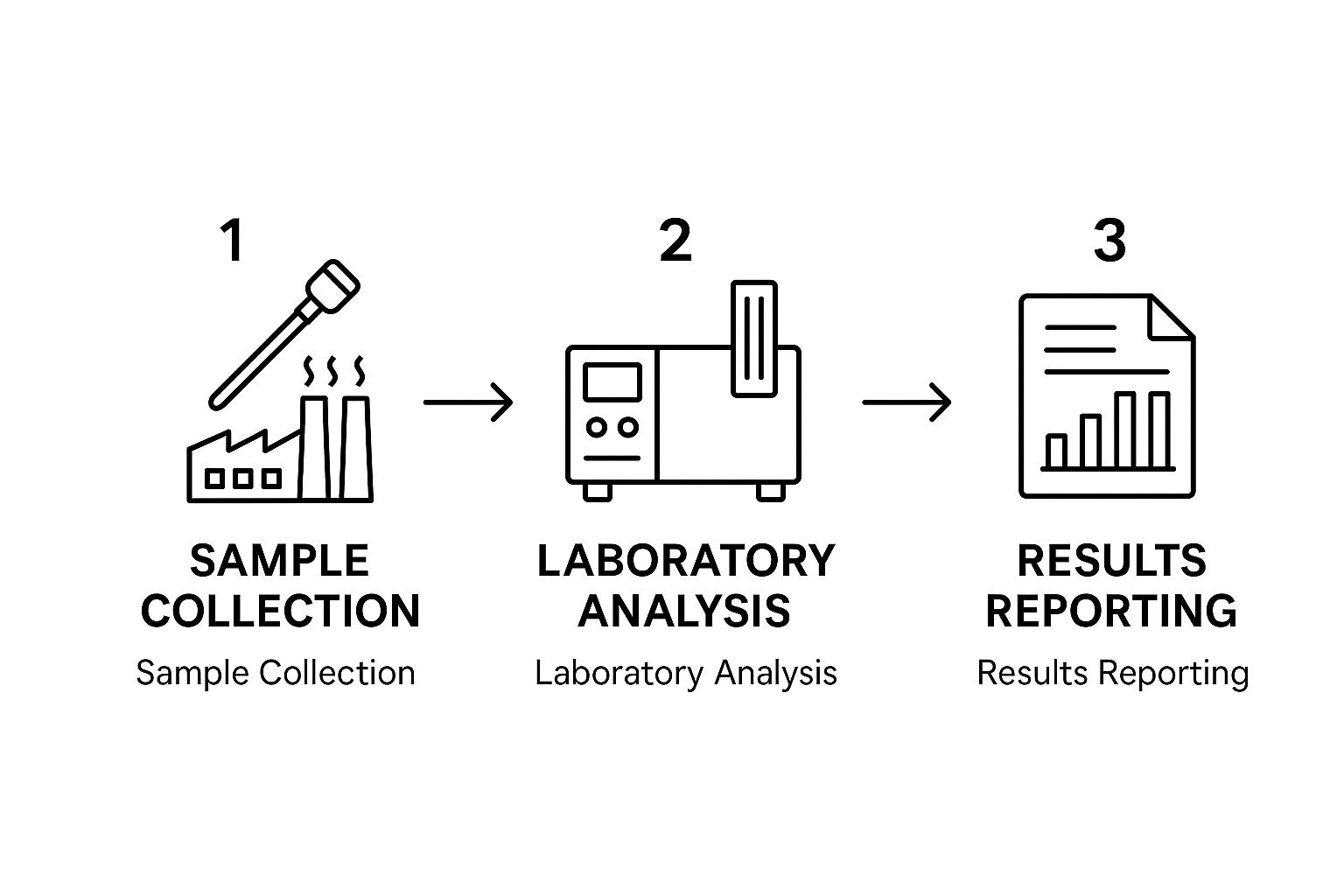

So, what actually happens when you hire a gas analysis service? It’s a carefully choreographed process that takes an invisible gas sample and turns it into a detailed, actionable report. Think of it as a three-act play, starting with capturing the gas on-site and ending with a comprehensive data breakdown that tells you everything you need to know.

Each step is critical. Meticulous control throughout the entire workflow is what guarantees the final numbers are accurate and trustworthy. Getting this right is fundamental, as these results drive major operational and financial decisions.

This visual gives you a great overview of how the process flows from field collection all the way to the final report.

This straightforward three-step process—collection, analysis, and reporting—is the foundation of any professional gas analysis. Let's break down what each stage involves.

Step 1: On-Site Sample Collection

Everything hinges on this first step. If the sample collection is flawed, the entire analysis is worthless. It's a bit like a doctor drawing blood; if the needle isn't sterile, the test results are compromised. In gas analysis, the standards are just as strict, if not more so.

A technician arrives on-site with specialized gear, typically stainless steel cylinders and probes designed to pull a sample directly from the gas stream. It's far more than just filling a bottle. They follow precise protocols to avoid contamination from the surrounding air and to prevent something called fractionation—where heavier hydrocarbon molecules can separate from the lighter ones, skewing the sample.

A poorly collected sample guarantees an inaccurate analysis. There are no do-overs once it gets to the lab.

This first step is all about capturing a perfect, representative snapshot of the gas exactly as it exists in the pipeline.

Step 2: Laboratory Analysis

With a pristine sample secured, it’s off to the lab. Here, the real magic happens using a sophisticated piece of equipment called a Gas Chromatograph, or GC for short. The GC is the workhorse of the industry, and its job is to deconstruct the gas mixture into its individual parts. Imagine a prism splitting white light into a rainbow; a GC does something similar for gas.

The gas sample is injected into the GC and travels through a very long, thin, coiled tube called a column. As it moves, different molecules travel at different speeds depending on their size and chemical properties. Lighter, zippier components like methane race through, while heavier ones like propane and butane take their time.

At the other end of the column, sensitive detectors identify each component as it emerges and measure its exact concentration. It’s an incredibly precise method that allows analysts to quantify every compound down to trace amounts.

To give you a clearer picture, here are the main components the GC is looking for and why they matter.

Key Components Measured in Natural Gas Analysis

This table outlines the primary components identified during a typical gas analysis and explains their significance for energy value and operational safety.

| Component | Chemical Formula | Primary Significance |

|---|---|---|

| Methane | CH₄ | The main component; determines the primary heating value. |

| Ethane | C₂H₆ | A valuable natural gas liquid (NGL) that adds to the energy content. |

| Propane | C₃H₈ | A key NGL; higher concentrations increase the gas's BTU value. |

| Butanes | C₄H₁₀ | Heavier hydrocarbons that significantly boost energy content. |

| Nitrogen | N₂ | An inert gas that dilutes energy content; high levels are undesirable. |

| Carbon Dioxide | CO₂ | A corrosive impurity that must be monitored and often removed. |

| Oxygen | O₂ | Can indicate sample contamination or create corrosive conditions. |

| Hydrogen Sulfide | H₂S | A toxic and corrosive contaminant that must be kept below strict limits. |

Ultimately, the Gas Chromatograph gives us the raw data needed to understand the gas's quality, value, and safety profile.

Step 3: Data Interpretation and Reporting

The GC spits out raw data in the form of electronic signals and graphs, which isn't very useful to anyone outside the lab. The final, crucial step is to translate that technical data into a clear, comprehensive report that a project manager or engineer can actually use.

This final document is the culmination of the entire service. It typically breaks down the findings into several key areas:

- Compositional Breakdown: A detailed list of every hydrocarbon and non-hydrocarbon component, usually expressed as a mole percentage.

- Heating Value (BTU): The calculated energy content of the gas. This is the single most important number for determining its market price.

- Relative Density: A measure of how heavy the gas is compared to air, which is essential for pipeline flow calculations and equipment settings.

- Impurity Levels: Precise measurements of contaminants like sulfur, water, and carbon dioxide, ensuring the gas meets safety and quality standards.

This report delivers the critical intelligence you need to manage your asset, meet contractual obligations, and ensure you're getting the right value for your natural gas.

The Technology Driving Accurate Gas Analysis

So, how do we turn an invisible, odorless gas sample into a detailed molecular blueprint? It all comes down to some seriously sophisticated lab equipment. The absolute workhorse of any professional gas analysis service is a technology called Gas Chromatography, or GC for short. This isn't just one tool among many; it's the gold standard.

Think of it like this: you have a big jar of mixed sand, salt, and sugar, and you need to know exactly how much of each is in there. A Gas Chromatograph does something similar, but on a molecular scale. It takes a raw gas sample and meticulously separates each individual component—methane, ethane, propane, nitrogen, you name it. Once separated, it can precisely measure the concentration of each one. This separation is what allows us to calculate the gas's energy content and, just as importantly, spot any unwanted impurities.

Core Technologies in the Lab

While the Gas Chromatograph is the star of the show, it doesn't work alone. A modern lab uses a suite of powerful tools that work in concert to build a complete, reliable picture of the gas quality. These supporting technologies help cross-verify results and can pick up on compounds that a GC might otherwise miss.

- Mass Spectrometry (MS): Often paired directly with a GC, a Mass Spectrometer acts like an incredibly precise molecular scale. It weighs each separated component, confirming its identity with an extremely high degree of certainty.

- Advanced Laser Sensors: These specialized devices use light to instantly detect specific problem molecules, like corrosive hydrogen sulfide (H₂S) or water. They're exceptionally sensitive and give immediate feedback on critical contaminants that can damage pipelines and equipment.

This kind of technology is constantly evolving. It's no surprise that the global market for gas analyzers was valued at around USD 4.39 billion in 2024 and is expected to keep growing, largely because of tightening regulations and the relentless push for better efficiency. You can read more about the gas analyzer market trends to see just how fast this field is moving.

The point of all this tech isn't just to spit out numbers on a report. It's about delivering trustworthy data that lets you make critical decisions about safety, compliance, and profitability with total confidence.

From the Lab to the Field

One of the biggest shifts we've seen in recent years is the move from the lab out to the field. While comprehensive lab-based analysis will always be the ultimate authority, portable analyzers now allow for rapid testing right on-site. These mobile or even handheld units bring the diagnostic power of the lab directly to the wellhead or pipeline.

This is a true game-changer. For immediate needs like troubleshooting a process upset, performing an initial well assessment, or running safety checks in a remote area, getting data in minutes instead of days is huge. It gives operators the agility to react quickly and solve problems before they escalate. It’s this constant innovation that allows a quality gas analysis service to deliver faster and more accurate results than ever before.

How to Choose the Right Gas Analysis Provider

Picking a gas analysis service isn't just another line item on a vendor list. It's more like choosing a specialist for a critical medical procedure. You wouldn't go with the cheapest surgeon; you’d look for expertise, precision, and a track record of reliable outcomes. The stakes are just as high here, where the financial and operational health of your entire project hinges on getting the right gas data.

Making a smart choice means looking past the price sheet and really digging into a provider's technical skills and dedication to quality. A provider who cuts corners on their process can hand you flawed data, and that can lead to a cascade of costly errors, safety hazards, and compliance headaches down the road.

Key Evaluation Criteria

When you start comparing providers, there are a few non-negotiable pillars of quality you need to focus on. These are the things that separate a true partner from a risky bet.

First off, ask about their accreditations. Is the lab ISO/IEC 17025 accredited? This is the gold standard for testing and calibration labs worldwide. It’s an independent verification that they have a solid quality management system in place and are technically competent to produce results you can trust. Think of it as a lab’s board certification.

But don't stop at the certificate on the wall. Dig into the experience of their team. How long have their chemists and technicians actually been working with natural gas? Real expertise isn't just about knowing how to run a machine. It's about understanding the subtle art of sample handling, interpreting messy data, and knowing what to do when the results look… weird. An experienced team will catch problems a less seasoned crew might not even notice.

Speed, Clarity, and Market Awareness

In the energy business, delays cost money. A lot of it. You need to ask about their standard turnaround time. How fast can they get you results, and what are the options if you need something expedited yesterday? A provider who gets the operational pressures you’re under will have built their processes for both speed and accuracy.

Also, always ask to see a sample report. Is it clear and easy to read, or is it just a jumble of numbers that you need a PhD to decipher? A great report doesn't just give you data; it gives you actionable insights.

Your chosen provider should deliver more than just data; they should deliver confidence. The right partner provides verifiable, timely, and clear results that empower you to make sound operational and financial decisions without a second thought.

Finally, a good provider knows the world you operate in. Take the North American gas analyzers market, for instance—a massive part of the global gas analysis service industry. It was valued at USD 1.26 billion in 2024 and is set to grow, thanks to tougher environmental rules and new sensor tech. A provider who understands these dynamics is better prepared to help you navigate changing compliance requirements. You can learn more about the trends driving the North American gas analysis market to get a feel for what a forward-thinking partner should be focused on.

Gas Analysis in Action with Real-World Examples

Theory is one thing, but seeing how a gas analysis service tackles real, high-stakes problems is where its value really clicks. This isn't just about ticking boxes for quality control. It’s about preventing disasters, locking in profits, and fine-tuning massive industrial operations.

Let's walk through a couple of scenarios where gas analysis becomes the most important tool in the shed.

Preventing a Pipeline Catastrophe

Imagine a midstream operator responsible for moving natural gas across hundreds of miles of pipeline. Their number one nightmare? Corrosion. It weakens the steel, leading to leaks or, in the worst-case scenario, a catastrophic failure. A primary cause of this is hydrogen sulfide (H₂S), a nasty, corrosive compound that can also be highly toxic.

The operator has a routine testing schedule with their gas analysis provider. During one of these regular checks, the lab flags a small but concerning spike in H₂S levels, tracing it back to a new gas well that just came online.

- Action Taken: Thanks to the immediate alert, the operator reroutes the contaminated gas to a treatment plant. There, the H₂S is scrubbed out before the gas ever hits the main transmission line.

- Result: This early catch prevented accelerated corrosion that could have damaged a multi-million-dollar pipeline. It stopped a potential environmental disaster in its tracks and kept the company compliant with safety regulations.

Securing Fair Value in a Sales Contract

Now, picture a natural gas producer who has a sales contract with a major utility. The contract is very specific: the gas must have a minimum BTU (British Thermal Unit) content. The BTU value is a direct measure of its energy, which dictates the price. If the gas quality dips below that threshold, the producer gets hit with steep financial penalties.

Before the gas reaches the custody transfer point where ownership changes hands, a sample is sent to a certified gas analysis service. The lab’s report confirms the gas is rich in high-energy hydrocarbons like ethane and propane, putting its BTU value a solid 5% above the contractual minimum.

This certified report acts as undeniable proof of quality. It ensures the producer gets paid the full price for their high-value product and builds a foundation of trust with the buyer.

What could have been a point of contention becomes a straightforward, transparent transaction. It protects the producer's revenue and guarantees a fair deal for everyone involved.

Answering Your Gas Analysis Questions

When you're dealing with a professional gas analysis service, a few questions always seem to pop up for project managers and operators. Getting straight answers is the first step to building a testing program that actually protects your assets and gives you an accurate valuation. Let's break down some of the most common ones.

How Often Should I Test My Natural Gas?

There’s no magic number here; the right testing frequency really depends on your specific situation. If you’re pulling from a stable, well-established source, checking in quarterly or even twice a year might be plenty to keep an eye on things.

But if you're bringing new wells online or mixing gas from different sources, you'll want to test much more often—maybe even weekly or monthly. This helps you get a handle on quality variations before they become a problem.

Your contracts will also have a lot to say about this. Any time gas changes hands at a custody transfer point, you can bet frequent, regular analysis is required to make sure every transaction is based on solid, current quality data.

Standard Versus Extended Analysis

Think of a standard gas analysis like a routine physical. It checks for the main components—methane, ethane, and so on—along with common impurities like nitrogen and CO₂. This gives you the core data needed to calculate the BTU value and make sure you're meeting pipeline specs.

An extended analysis is more like visiting a specialist for a deeper look. It's designed to hunt for trace contaminants that can cause major operational headaches, even in parts-per-million concentrations.

An extended analysis becomes absolutely critical when you have a hunch that something damaging is lurking in your gas stream. This could mean testing for mercury, which can literally eat through equipment, or doing a full sulfur speciation to identify specific corrosive compounds beyond just H₂S. This detailed view gives you a complete picture of your operational risk.

On-Site Versus Laboratory Testing

Choosing between testing on-site or sending a sample to a lab is all about balancing speed against precision. On-site analysis with a portable unit gives you answers right now, which is perfect for real-time process control, quick troubleshooting, or just spot-checking quality out in the field.

However, when you need the highest level of accuracy and a complete breakdown of every component, nothing beats a dedicated laboratory. Lab-based Gas Chromatographs and other sophisticated instruments provide the certified, definitive data you need for contractual agreements and to satisfy regulatory requirements.

At Blue Gas Express, we know that a steady supply of natural gas is the lifeblood of your project. If you’re dealing with delays or an unexpected outage, our mobile CNG and LNG solutions can deliver the reliable temporary gas you need to keep things moving.

Don't let a supply issue derail your project. Find out more about our rapid deployment services at https://bluegasexpress.com.