When people talk about the price of hydrogen per kilogram, they're not talking about one single number. The reality is a huge range, stretching from $1-$2 for grey hydrogen all the way to over $6 for green hydrogen—and that's before you even factor in the steep costs of delivery.

The final price you'll actually pay is a complex mix of production, compression, storage, and transportation expenses. More often than not, these logistics costs can easily eclipse the cost of the fuel itself.

What Actually Makes Up The Hydrogen Gas Price Per Kg

Thinking about the price of hydrogen is a bit like buying a bottle of water. The water itself costs next to nothing, but what you’re really paying for is the purification, bottling, shipping, and the store’s markup. It's the same story with hydrogen. The final price per kg is built on a chain of essential—and expensive—logistical steps. The initial production cost is just the starting line.

To make sense of a supplier's quote, you need to peel back the layers of these bundled expenses. The process starts with how the hydrogen is made, which is where the famous "colors" come in.

- Grey Hydrogen: This is the most common and cheapest form on the market today, produced from natural gas. Its price is directly hitched to the notoriously volatile fossil fuel markets.

- Blue Hydrogen: This is essentially grey hydrogen with an expensive add-on: capturing the carbon emissions generated during production.

- Green Hydrogen: Produced by splitting water with renewable electricity, its cost hinges on electricity prices and the efficiency of the electrolysis equipment.

Each "color" sets a different baseline price before a single kilogram ever leaves the production plant. From there, the costs start to stack up fast. Because hydrogen has such a low density, it has to be compressed to incredibly high pressures or chilled to cryogenic liquid form just to be moved around efficiently.

The crucial takeaway is this: Production often accounts for less than half of the final delivered price. The majority of what you pay covers the energy-intensive processes of compression, specialized storage, and last-mile delivery to your site.

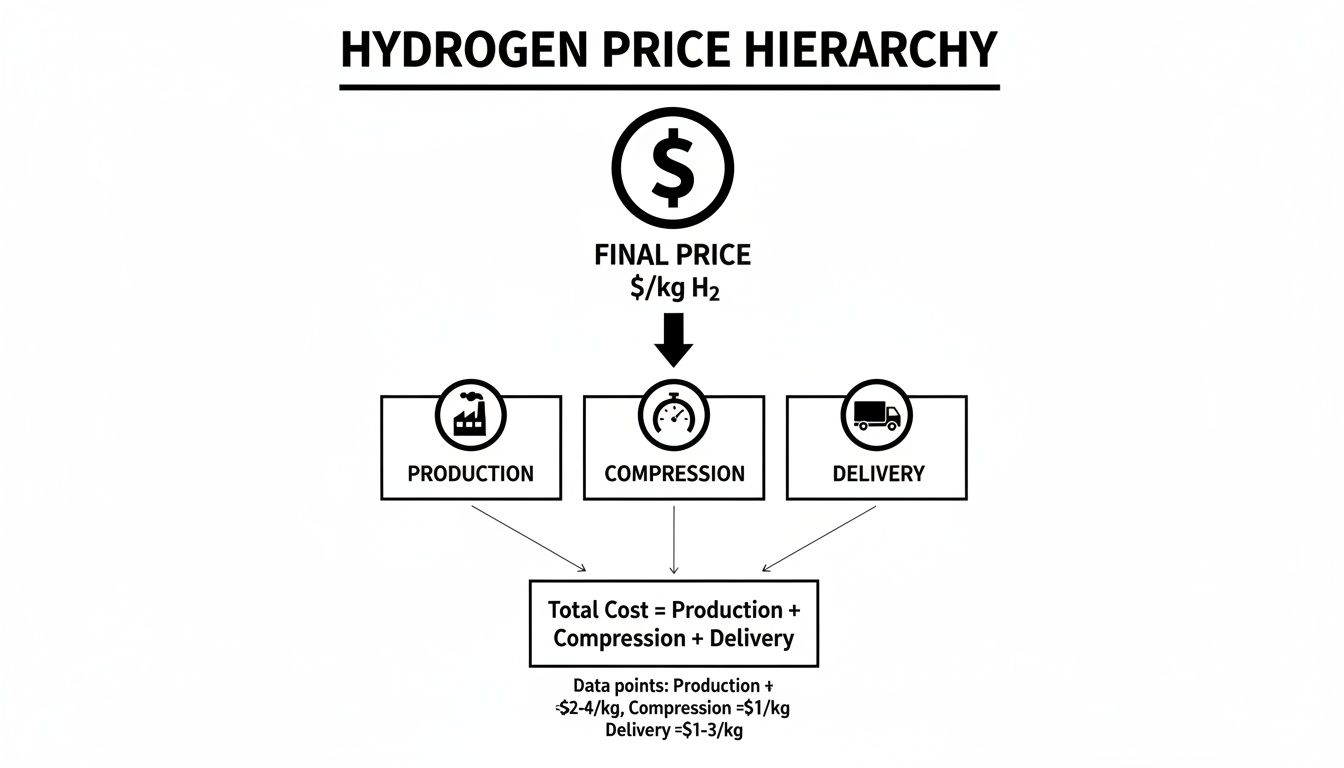

This diagram shows how all those costs build on each other to form the final price you pay.

As you can see, the final price is really a hierarchy of costs, with each stage adding a significant slice to the total.

Key Components Driving The Final Hydrogen Price

To simplify, here’s a quick breakdown of the major costs that contribute to the delivered price of hydrogen gas.

| Cost Component | What It Covers | Typical % of Final Price |

|---|---|---|

| Production | The "color" of hydrogen (grey, blue, green), including feedstock (e.g., natural gas) and energy (e.g., electricity for electrolysis). | 30% – 50% |

| Compression/Liquefaction | The energy-intensive process of increasing hydrogen's density for transport. This is a non-negotiable step. | 20% – 30% |

| Storage & Transportation | The cost of specialized high-pressure tanks or cryogenic trailers and the fuel/labor for trucking it to your location. | 25% – 40% |

| Dispensing & On-Site Fees | "Last mile" costs, including on-site storage, dispensing equipment, and any local service or handling charges from the supplier. | 5% – 10% |

Understanding this framework is the first step to accurately budgeting for a hydrogen project and seeing why a simple production cost figure can be so misleading. You’re not just buying hydrogen; you’re buying a complex logistical service.

How Hydrogen's "Color" Dictates Its Base Cost

Before you can forecast your project’s fuel budget, you have to grasp a fundamental concept: not all hydrogen is created equal. The hydrogen gas price per kg you’ll see on a quote is a direct reflection of how it was made.

We use a simple color code to describe these production methods. These "colors"—grey, blue, and green—aren't just industry slang. They represent vastly different supply chains, each with its own unique cost structure. Getting this right is the first step to making an informed decision.

Think of grey hydrogen as the incumbent, the old guard. It’s made using a process called steam methane reforming (SMR), which essentially uses natural gas as the main ingredient. Because this technology is mature and widespread, grey hydrogen is currently the most common and cheapest option available, with production costs typically sitting between $1 to $2 per kilogram.

But that affordability comes with a big string attached. Its price is directly chained to the notoriously volatile natural gas market. Any time a geopolitical event or supply chain hiccup causes gas prices to spike, the cost of grey hydrogen shoots up right alongside it. This can make long-term budget planning a real headache.

Upgrading to Blue and Green Hydrogen

Blue hydrogen is really just grey hydrogen with a crucial, and expensive, upgrade. It starts with the same SMR process, but then it adds carbon capture and storage (CCS) technology to trap the CO₂ emissions before they can escape into the atmosphere.

This makes it a much cleaner option than grey, but bolting on a CCS system isn't cheap. That extra step pushes the production cost up, usually into the $1.50 to $3 per kilogram range. The exact price tag depends on the scale and efficiency of the carbon capture facility.

Green hydrogen represents a complete break from fossil fuels. It’s produced via electrolysis—a process that uses electricity to split water (H₂O) into hydrogen and oxygen, with zero carbon emissions.

This completely rewrites the cost formula. Instead of being tied to natural gas prices, the cost of green hydrogen hinges on two completely different factors:

- The price of renewable electricity: Electrolysis is an energy-hungry process, so the cost of the wind or solar power feeding it is the single biggest variable.

- The capital cost of electrolyzers: The machinery that actually performs the water-splitting is a major upfront investment.

For now, green hydrogen is the most expensive of the three, with production costs falling anywhere from $3 to $7 per kilogram. That premium reflects the current cost of building out new renewable energy projects and scaling up electrolyzer manufacturing.

However, nearly everyone expects this to change. As the price of renewables continues to drop and electrolyzer technology gets cheaper with mass production, green hydrogen is on a clear path to becoming far more competitive. Understanding these fundamental differences is the key to decoding any supplier's quote and choosing the right type of hydrogen for your project's budget and sustainability goals.

Why Hydrogen Prices Vary So Much By Region

The hydrogen gas price per kg is anything but universal. A quote for a project in California means next to nothing for a job site in North Carolina or Virginia, simply because local factors create massive price differences. Thinking globally will only mislead you; hydrogen pricing is a hyperlocal game.

This variation really comes down to a few core drivers that are different everywhere you look. The biggest one is the cost of the primary feedstock—whether that's natural gas for grey hydrogen or electricity for green hydrogen. It's common sense: a region with abundant, cheap solar power will naturally produce more affordable green hydrogen. On the flip side, an area reliant on imported natural gas will face higher, more volatile costs for grey hydrogen.

This dynamic creates a patchwork of distinct pricing zones across North America, Europe, and Asia. It's not a single, unified commodity market.

Local Energy Costs and Infrastructure Quality

The quality of local infrastructure is another huge variable. Regions with established industrial gas pipelines and solid transportation networks can deliver hydrogen far more efficiently, which keeps those last-mile costs in check. But if your construction site is out in the middle of nowhere, far from a production hub, you can bet the final price per kg will be inflated by steep transportation fees.

Government incentives also play a massive role in shaping regional markets. Some states or countries offer hefty tax credits or subsidies for green hydrogen production, directly lowering its cost. This can create "hydrogen hubs" where prices are artificially lower than in neighboring areas that lack the same political support.

A price quote is just a snapshot of a specific location's energy grid, logistical capabilities, and political climate. You have to analyze these local conditions to get a realistic budget for your project.

We saw just how sensitive this is during recent energy crises. In the first half of 2022, the price of electrolytic hydrogen in the US shot up to $16.80/kg because of the same inflation hitting crude oil and natural gas. Grey hydrogen producers got hit with a brutal double-whammy: soaring natural gas feedstock costs and higher electricity prices. They had no choice but to pass those costs directly to buyers. You can dig into the detailed hydrogen price trends from that period to see just how volatile things got.

Regional Price Snapshot: A Global Comparison

To put this into perspective, let's look at how these factors create wildly different price realities around the world.

- North America: Prices are all over the map between states. The US Gulf Coast, with its vast natural gas infrastructure, often has some of the cheapest grey hydrogen. Contrast that with California, where retail prices have hit $27.11/kg to $32.94/kg, driven by aggressive green mandates and sky-high distribution costs.

- Europe: The EU is pushing hard for decarbonization with initiatives like the Green Deal, which heavily incentivizes green hydrogen. But prices are still steep, generally ranging from €3 to €7 per kilogram, and they're tied directly to the notoriously volatile European electricity market.

- Asia-Pacific: Countries like Japan and South Korea don't have many domestic resources, so they're focused on hydrogen imports. This makes them price-takers on the global market. Meanwhile, Australia is positioning itself as a major exporter, aiming to produce some of the world's cheapest green hydrogen by tapping its immense solar and wind potential.

This regional split just hammers home why a localized cost analysis is non-negotiable for any serious project planning.

The Hidden Costs of Delivery and Storage

Here’s a critical insight that many buyers miss when evaluating the hydrogen gas price per kg: the cost to actually make the gas is often less than 20% of your final bill. The real expenses are hiding in plain sight, buried in the complex journey hydrogen takes from the production plant to your project site.

Hydrogen is the lightest element in the universe, a simple fact with enormous financial consequences. To move it efficiently, you have to either compress it to extreme pressures—often 700 bar, or over 10,000 PSI—or chill it to a cryogenic liquid at -253°C. Both options are incredibly energy-intensive and demand specialized, expensive equipment that makes natural gas infrastructure look simple.

From Production Gate to Your Site

These "downstream" costs are where the initial production price can easily double or even triple. Think of it like this: the price a farmer gets for potatoes is a fraction of what you pay for a bag of chips. All the processing, packaging, and shipping in between adds the real cost. That's the reality check for anyone budgeting for hydrogen.

This isn't just theory; the numbers from the real world tell the same story. Take California, where retail hydrogen prices have consistently blown past optimistic forecasts. After hitting a range of $8.50/kg to $10.80/kg back in 2021, prices kept climbing, reaching as high as $27.11/kg by early 2024. If you want to see how these prices stack up against traditional fuels, you can review this detailed cost comparison. This trend makes one thing crystal clear: production is just a small piece of the puzzle. Compression and delivery dominate the final price tag.

The logistical challenge of moving hydrogen is its primary cost driver. Unlike natural gas, which flows through established, low-pressure pipelines, hydrogen demands a purpose-built, high-cost supply chain for every single delivery.

Beyond the obvious expenses, you also have to account for subtle operational factors. Many of the same principles that create hidden costs of warehouse complexity apply here—inefficiencies in handling and logistics quickly inflate your budget.

Breaking Down the Delivery Cost Stack

The final price you pay is a layered cake of expenses. Each stage adds a significant slice to the initial production cost, which is why a simple "at the gate" per-kg figure is so misleading for any real-world project budget.

Here's a simplified look at how those costs can stack up, turning an attractive production price into a much higher delivered cost.

How Production Costs Inflate to a Final Delivered Price

| Cost Stage | Example Cost Per Kg | Key Activities Involved |

|---|---|---|

| Production (Green H2) | $4.00 | Electrolysis, renewable electricity purchase, and initial purification. |

| Compression/Liquefaction | +$2.50 | Energy-intensive process to increase hydrogen's density for transport. |

| Storage & Transportation | +$3.00 | Specialized high-pressure tube trailers or cryogenic tankers; fuel/labor for trucking. |

| Dispensing & On-Site Fees | +$1.50 | "Last mile" costs, including on-site storage, dispensing equipment, and service charges. |

| Total Delivered Price | $11.00 | The realistic cost at your site, nearly triple the initial production cost. |

As you can see, what starts as $4.00/kg hydrogen can easily become $11.00/kg by the time it's ready for you to use. This is the single most important concept to grasp when planning and budgeting for a hydrogen project.

Comparing Hydrogen to Natural Gas on an Energy Basis

To make a smart fuel choice, you need a true apples-to-apples comparison. The hydrogen gas price per kg is a good starting point, but it doesn't really tell you how much energy you're buying. To see how it stacks up against familiar fuels like natural gas, you have to convert kilograms into common energy units.

This is a critical step for anyone evaluating fuel for generators, industrial heaters, or manufacturing processes. A single kilogram of hydrogen packs a serious punch—about 33.3 kilowatt-hours (kWh) of energy, which is roughly 0.12 million British thermal units (MMBtu). That energy density is fantastic, but for your bottom line, it's the cost per unit of that energy that truly counts.

When you actually do the math, the reality becomes clear. Even if hydrogen's production cost looks appealing, the final delivered price for the energy you can use is often much, much higher than traditional fuels.

Putting the Numbers into Perspective

Let's walk through a quick, real-world example. Say you're getting delivered green hydrogen at a cost of $11.00 per kg. We can use this to calculate its energy-equivalent price and put it head-to-head with natural gas or diesel.

- Cost per kWh: Just divide the price per kg by its energy content. So, $11.00 / 33.3 kWh comes out to about $0.33 per kWh.

- Cost per MMBtu: Same idea here. $11.00 / 0.12 MMBtu gives you a price of roughly $91.67 per MMBtu.

These are the numbers you need for accurate financial planning and budgeting.

Here's the key takeaway: While hydrogen is incredibly energy-dense by weight, its complex and expensive logistics chain often inflates the cost per unit of usable energy. Getting this calculation right is the difference between a successful project and a major budget overrun.

Energy Cost Showdown: Hydrogen vs. Natural Gas

This direct comparison really shines a light on the huge cost gap that appears once you look past the price per kilogram.

| Fuel Type | Typical Delivered Price | Energy-Equivalent Cost | Key Consideration |

|---|---|---|---|

| Green Hydrogen | $11.00 / kg | ~$91.67 / MMBtu | High cost is driven by production, compression, and specialized delivery logistics. |

| Natural Gas | $4.00 / MMBtu | $4.00 / MMBtu | Mature infrastructure and lower costs make it the affordable incumbent. |

As you can see, the energy from hydrogen in this scenario is over 20 times more expensive than the energy you'd get from natural gas. This economic reality is precisely why temporary natural gas solutions from providers like Blue Gas Express are so valuable, especially when you're transitioning to new systems or dealing with pipeline construction delays. It’s a way to keep your operations running without paying a massive premium.

How to Get a Realistic Hydrogen Cost Estimate

Getting a real-world cost for hydrogen isn't as simple as looking at a price sheet. The number you see for the hydrogen gas price per kg is just the beginning. To build a reliable budget, you have to think about the entire journey that hydrogen takes to get to your job site.

Think of it like any other critical material for a project. You wouldn't just ask for the price of steel; you'd ask about delivery, fabrication, and finishing. The same detailed approach is needed here, because the final, all-in cost is shaped by your project's location, how much you'll use, and your specific on-site needs.

To get past the advertised price and find the true cost, you need to ask suppliers some pointed questions.

Key Questions for Your Hydrogen Supplier

- Production Method: How was this hydrogen made? Is it grey, blue, or green? Knowing this tells you the baseline cost and how much it might swing with changes in natural gas or electricity prices.

- Transportation Logistics: How are you getting it to me? You need to know if it's coming via a tube trailer or a liquid tanker, the distance from their plant to your site, and exactly what the freight charges are.

- On-Site Storage Requirements: What do I need to store it on-site? Be sure to clarify costs for renting, installing, and maintaining any high-pressure tanks or cryogenic vessels.

- Local Cost Factors: Are there any local costs I should know about? Ask how local electricity rates affect their compression costs and if any regional surcharges or taxes are baked into the final price.

A supplier’s answers to these questions will uncover the hidden costs that can easily inflate that initial per-kilogram price. This is especially true for projects outside of major metro areas, where delivery premiums can be significant.

For example, a construction project in rural Tennessee will face a completely different cost structure than one in a big industrial hub near Houston. This isn't a new problem. In fact, a detailed analysis projected that even by mid-century, costs in non-metro areas could be nearly double those in urban centers simply due to distribution and scale issues. You can learn more about these regional hydrogen cost disparities in this report.

When you're armed with this kind of information, you can push back on assumptions and build a budget that won't give you any surprises down the line.

Common Questions About Hydrogen Gas Pricing

Getting into hydrogen fuel brings up a lot of questions, especially about the cost. If you're a buyer in the industrial or construction space, getting a solid grip on the hydrogen gas price per kg is key to making your budget work and planning ahead. Let’s tackle some of the most common questions we hear from people on the ground.

Why Is Green Hydrogen Still So Expensive?

It’s a fair question, especially since we hear so much about renewable energy getting cheaper. The reality is, two big-ticket items keep green hydrogen prices up. The first is the massive upfront cost of the electrolyzer equipment—the hardware that actually splits water to make the hydrogen.

The second, and often overlooked, expense is the sheer amount of energy needed to compress or liquefy the gas so it can be moved. Hydrogen doesn’t have a handy, built-in pipeline network like natural gas. It requires a dedicated, high-pressure supply chain from the production plant to your site, and every step in that chain adds to the final price tag.

Does Buying in Bulk Lower The Price Per Kg?

Absolutely. Volume is one of the biggest levers you can pull to influence your price. A large, steady order for a manufacturing plant is almost always going to command a much better price per kg than smaller, on-and-off deliveries for a temporary construction project.

Think of it from the supplier's perspective. High-volume customers let them build efficient, predictable delivery schedules and storage plans. That efficiency saves them money on logistics, and they'll usually pass a good chunk of those savings on to you.

A long-term, high-volume contract is your best negotiation tool. Suppliers value the predictability and are often willing to offer substantial discounts compared to one-off or short-term agreements for smaller quantities.

What Are The Hidden Safety and Regulatory Costs?

This is where many project budgets get tripped up. Hydrogen is governed by strict safety rules that add real, and sometimes significant, costs to your total project. These aren’t optional—they're required for safe, legal operation.

- Specialized Storage: You can't just use any old tank. You'll need high-pressure or cryogenic storage systems, which are a whole different ballgame—and price point—compared to standard fuel tanks.

- Advanced Monitoring: Sophisticated leak detectors and powerful ventilation systems are a must-have to manage the risks.

- Comprehensive Training: Your team needs to be properly trained to handle a high-pressure, flammable gas. This isn't just a one-time thing; it's an ongoing operational cost.

Frankly, getting all this right is often more complex and expensive than what you might be used to with traditional fuels like natural gas.

When project timelines can't wait for permanent gas lines, temporary fuel solutions are essential. Blue Gas Express provides rapid-deployment mobile CNG and LNG units across the Southeast, ensuring your construction projects, generator commissioning, and operational needs are met without interruption. Keep your projects on schedule by visiting the Blue Gas Express website to secure a reliable temporary gas supply.